Finding Your Perfect Capital Partner

tl;dr

Define your values and needs clearly to align with investors who share your vision and can provide strategic support.

Seek investors with industry-specific knowledge and a network that can offer valuable insights and connections.

Choose between active and passive, retail vs institutional investors based on your business's growth stage and goals for optimal partnership fit.

In the world of entrepreneurship, landing the right investor can be the key to propelling your business forward. From many, it’s a critical step to growth or survival. Finding the perfect capital partner goes beyond just depositing a check. It involves aligning values, understanding your industry's nuances, and choosing the right type of investor to fit your business needs. Here’s how you can navigate this crucial process to find the perfect capital partner.

Define Your Values and Needs

Before embarking on your search for an investor, it’s important to clearly define what you value in a partnership. Do you need an investor who prioritizes sustainability and ethical practices? Are you looking for someone who can provide mentorship and connections? Perhaps your priority is finding someone with plays a more passive role, and let’s you drive your vision. Establishing these values early on will guide you in identifying investors who align with your business goals. Your definition of “perfect” will be unique to you.

Finding an Investor Who Knows Your Space

Many entrepreneurs are on the hunt for the right investor who understands your industry. An investor with industry-specific knowledge can provide not only financial support but also valuable insights, connections, and mentorship. Here are a few steps to help you find an investor who knows your space:

Network Within Your Industry: Attend industry conferences, trade shows, and networking events. These venues are excellent for meeting potential investors who are already engaged in your sector.

Research Investment Firms: Look for investment firms that specialize in your industry. Many firms have specific focus areas, and their portfolio companies can give you an idea of their expertise and interest.

Leverage Online Platforms: Use platforms like AngelList, LinkedIn, and Crunchbase to identify investors with a track record in your industry. These platforms often provide detailed information about an investor's previous investments and areas of interest.

Seek Recommendations: Talk to other entrepreneurs in your industry. They can provide valuable referrals and insights into investors who have been strong partners.

Active vs. Passive Investors

Understanding whether you need an active or passive investor is crucial.

Active Investors: These investors take a hands-on approach, offering strategic advice, operational support, and networking opportunities. They can be particularly beneficial if you need guidance and mentorship.

Passive Investors: These investors provide capital with minimal involvement in the day-to-day operations of your business. They are ideal if you prefer to retain more control over your business decisions.

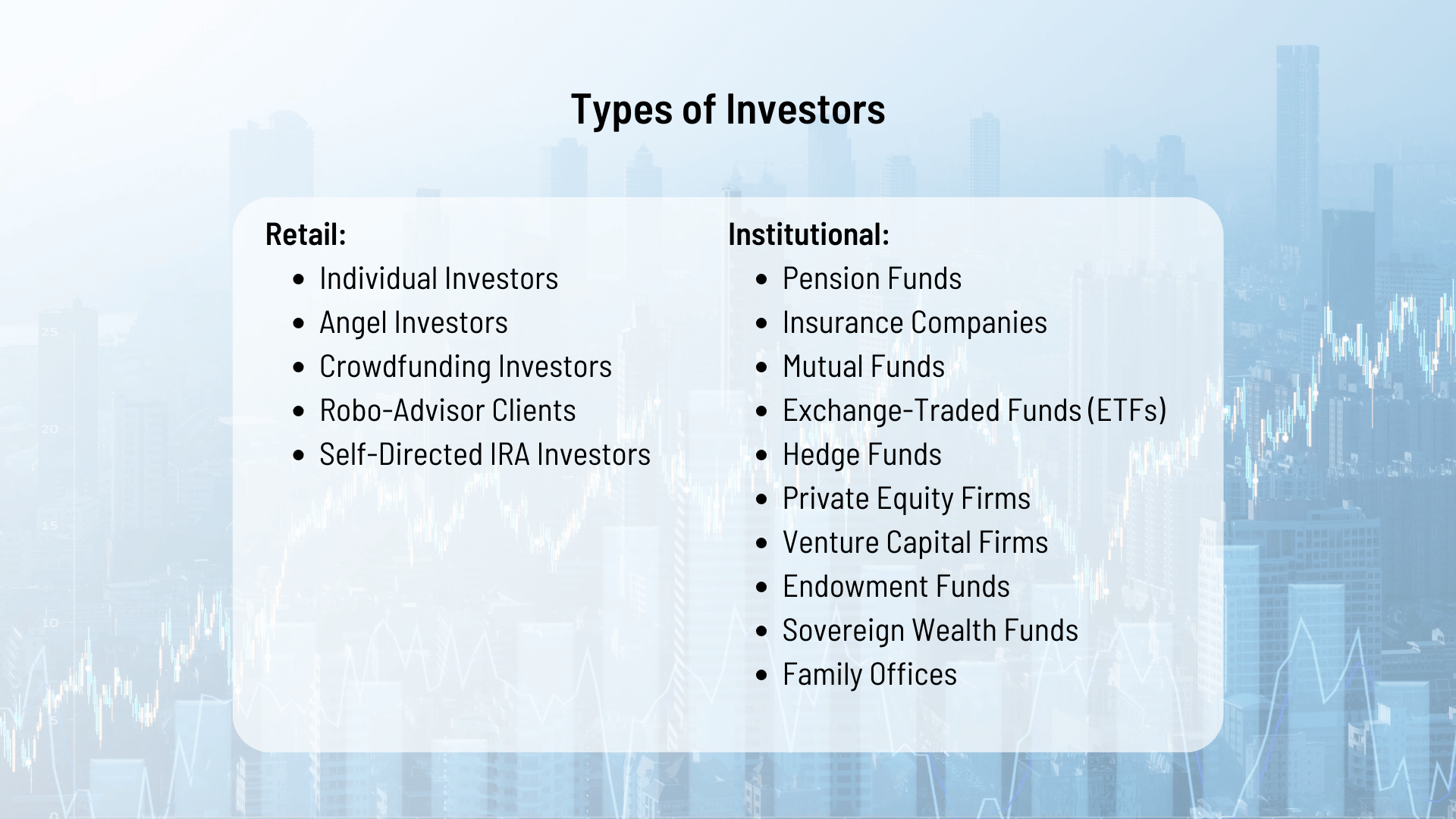

Retail Investors vs. Institutional Investors

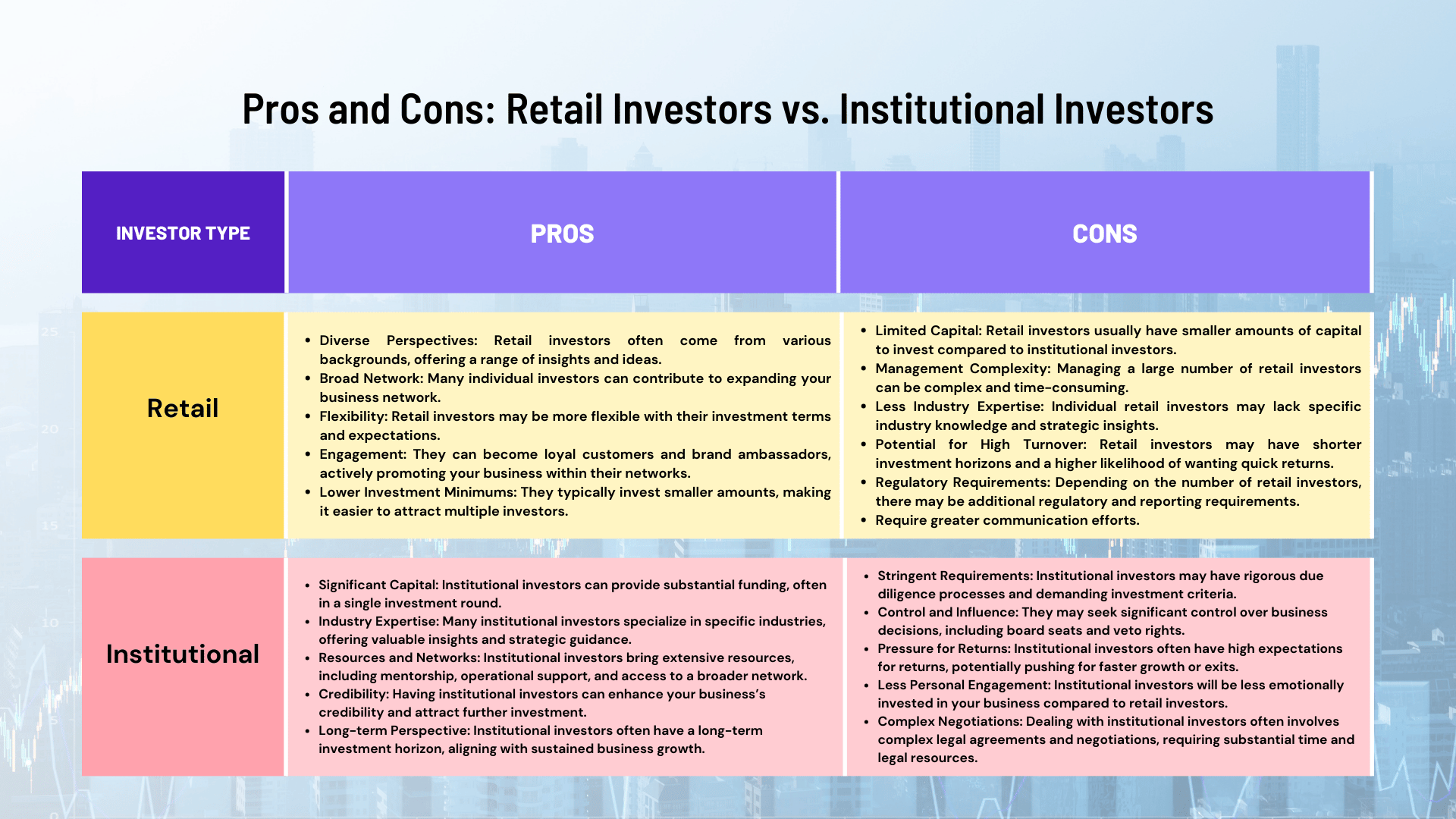

Bringing on retail vs institutional investors can significantly impact your business.

Retail Investors: These are individual investors who might invest smaller amounts but bring diverse perspectives and networks. Crowdfunding platforms are a popular way to attract retail investors.

Institutional Investors: These include venture capital firms, private equity funds, and corporate investors. They often invest larger sums and can provide extensive resources and strategic partnerships. However, they may also demand more rigorous financial oversight and governance but require less communications and engagement than retail.

Choosing between retail and institutional investors depends on your business needs, growth stage, and long-term goals. Retail investors can offer flexibility and engagement but come with management complexity and limited capital. Institutional investors provide significant resources and expertise but demand stringent requirements and greater control. Understanding these pros and cons will help you make an informed decision on the best investment partner for your business.

Cracking the Family Office Code

Family offices are private wealth management firms that manage the investments of high-net-worth families. Having a family office investor can bring several advantages:

Long-term Perspective: Family offices often have a long-term investment horizon, which can be beneficial for businesses focused on sustainable growth rather than quick exits.

Personalized Attention: Since family offices typically manage fewer clients, they can offer more personalized attention and support.

Flexibility: They can be more flexible in their investment terms compared to traditional institutional investors, often providing tailored solutions that align with your business needs.

Securing investment from family offices can challenging due to their rigorous due diligence processes and a strong focus on capital preservation. Put yourself in the shoes of the Chief Investment Officer who manages the fortune of an ultra high-net-worth family, who have worked diligently to build and maintain their wealth over generations. Taking early-stage risk, generally speaking, is not their approach. Consequently, family offices tend to prioritize investments that offer stability and long-term security, rather than the high-risk, high-reward opportunities often associated with startups. Their meticulous approach to evaluating potential investments means that they thoroughly scrutinize every aspect of a business, from financial health to market potential and management integrity, ensuring that their capital is safeguarded against undue risks. This cautious investment philosophy makes it difficult for many startups to attract family office investors, who generally prefer safer, more predictable returns.

If you’re going after family offices, be prepared to exercise persistence and strategy. Start by seeking a warm introduction; connections through mutual acquaintances or industry contacts can significantly increase your chances of getting noticed. Family offices value trust and personal relationships, so leveraging your network is crucial. Once you have an in, be ready to invest time and effort into building a rapport. Traveling to meet them in person demonstrates your commitment and seriousness about the partnership. Additionally, brace yourself for a lengthy and meticulous due diligence process.

Family offices are known for their thorough evaluation methods, ensuring that their hard-earned capital is preserved and invested wisely. This means you must be prepared to provide extensive documentation, detailed financials, and a compelling, risk-mitigated business plan. Patience and perseverance are key, as building these relationships and securing investment can take considerable time.

Finding the perfect capital partner is a nuanced process that requires careful consideration of your values, industry knowledge, and the type of investor that best suits your business. By defining what you need, actively seeking investors who understand your space, and choosing the right type of investor, you can secure a partnership that not only provides capital but also supports your business's long-term success.

Remember, the right investor is not just a source of funds, but a partner in your journey towards growth and innovation.

What to Look For in an Investor – A Checkbox System

When seeking investors, entrepreneurs often look for more than just capital. Here’s our list of qualities and attributes that companies typically seek in an investor:

Aligned Vision and Values: Shared long-term vision and goals. Alignment with the company’s mission, values, and culture.

Industry Expertise: Knowledge and experience in the company’s industry. Understanding of market trends and industry-specific challenges.

Strategic Guidance: Ability to provide strategic advice and mentorship. Experience in scaling businesses and navigating growth challenges.

Network and Connections: Access to a valuable network of industry contacts, potential partners, and customers. Ability to open doors to new opportunities and resources.

Reputation and Credibility: A strong reputation in the business and investment community. Credibility that can enhance the company’s image and attract additional investors.

Financial Stability: Adequate financial resources to support the company’s growth and future funding needs. Ability to participate in multiple rounds of funding if necessary.

Commitment and Involvement: A genuine interest in the company’s success and willingness to be involved. Commitment to a long-term partnership rather than seeking quick exits.

Terms and Conditions: Fair and reasonable investment terms and conditions. Flexibility and willingness to negotiate terms that are mutually beneficial.

Patience and Understanding: Patience with the company’s growth timeline and recognition of the time required to achieve milestones. Understanding of the business’s unique challenges and opportunities.

Value-Add: Ability to provide additional resources such as marketing support, operational expertise, or technical assistance. Offering value beyond just financial investment.

Governance and Control: Reasonable expectations regarding governance and control over business decisions. Willingness to support the existing management team and respect their autonomy.

Track Record: Proven success in previous investments and a track record of supporting companies through various growth stages. References from other entrepreneurs and businesses they have invested in.

Transparency and Communication: Open and transparent communication style. Willingness to share insights, progress, and challenges openly and honestly.

Cultural Fit: A good cultural fit with the company’s team and existing stakeholders. Ability to work well with the company’s management and employees. By considering these factors, companies can identify investors who not only provide the necessary capital but also contribute to the overall success and growth of the business.